Here’s something to smile about: Tips for the 85 percent of young adults who don’t have room for third molars.

(NAPSI)—This year, more than five million Americans, mostly between the ages of 17 and 25, will have their wisdom teeth removed to prevent or address teeth crowding or pain. Dentists recommend that most people (85%) have their wisdom teeth taken out to prevent health issues—such as impactions, infections, or decay—because modern mouths are smaller than our ancestors’ and typically don’t have room for this third set of molars.

That’s the why. But when is best for this preventive surgery? Wisdom teeth (so-called because of how late in life they form, once a person has a bit more wisdom), are easiest to remove when the roots are not yet fully formed, so many dentists recommend removing them in late adolescence. Waiting until they come in fully can make extraction and recovery more difficult.

According to Nadia Fugate, DMD, a licensed dentist who serves as a Delta Dental of Washington dental consultant, “Many people’s mouths just aren’t big enough for all 32 teeth, making crowding issues worse. This leads to potential damage to the adjacent teeth, difficulty keeping teeth clean and leading to decay or infections of the gums around these teeth. Wisdom teeth can also cause jaw, muscle, and headache pain. Because every person’s mouth is different, you should ask your dentist if your or your child’s wisdom teeth need to be removed.”

Wisdom teeth recovery tips for patients and caregivers

While removing wisdom teeth requires outpatient surgery and anesthesia, the extraction process itself is usually short and pain-free. The more difficult part for wisdom teeth extraction patients is the recovery portion, which typically lasts between three and seven days.

The first two days are the most painful and is when blood clots form to protect the wound from infection and prevent excess bleeding. During this period, patients should keep the area clean, brush gently near the extraction site and avoid chewing.

Pain relief medication, such as ibuprofen or acetaminophen, can be taken as needed. Dentists recommend icing the cheeks on the first day and keeping the head elevated. A gentle rinse with antiseptic mouthwash is okay after the first 24 hours. Additional gauze can be applied to the surgery site if there is a lot of bleeding. In some cases, sutures will need to be removed by the dentist, about a week after surgery.

As far as food is concerned, for the first two days, consuming yogurt, pudding, smoothies and liquids is fine but don’t use a straw; it can loosen blood clots. After then, patients can eat soft foods such as scrambled eggs, Jell-O or mashed potatoes. Most importantly, avoid hard or sticky foods for at least a week, as well as foods with seeds which can easily get stuck in the extraction site.

Complications are rare and, typically, the only thing you may need is to have sutures removed, approximately one week after the surgery. Watch for signs of fever, difficulty swallowing or breathing, persistent numbness or pus oozing from the socket and alert your caregiver if any of those symptoms arise. Swelling should reduce after two days; let your dentist know if it doesn’t.

One of the more serious complications of wisdom tooth removal is a condition known as “dry socket,” in which the protective blood clot is disturbed and the bone is exposed to air, food, and bacteria. This can be very painful, as well as a cause of infection. Avoiding the use of straws, smoking, spitting or getting strenuous exercise for the first two weeks after surgery can help prevent this condition.

Learn More

For more facts about wisdom teeth, visit www.DeltaDentalWA.com/blog.

(NAPSI)—Entering the second holiday season of the COVID-19 pandemic, Idahoans are eager to reconnect with family and friends and return to treasured holiday traditions. Some simple steps can keep family and friends healthy through their fall and winter celebrations.

(NAPSI)—Entering the second holiday season of the COVID-19 pandemic, Idahoans are eager to reconnect with family and friends and return to treasured holiday traditions. Some simple steps can keep family and friends healthy through their fall and winter celebrations.

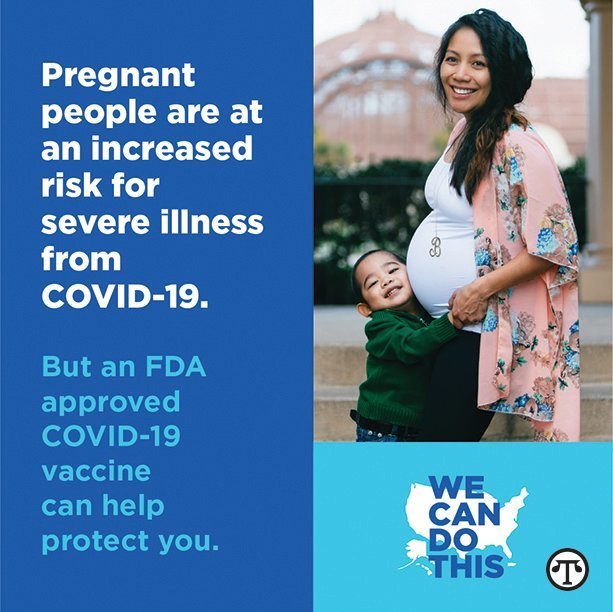

(NAPSI)—Children and teens are catching and spreading COVID-19 at an increasingly high rate. Even if your child or teen has not yet contracted COVID-19, they are at risk, especially with the low number of vaccinated residents in North Dakota.

(NAPSI)—Children and teens are catching and spreading COVID-19 at an increasingly high rate. Even if your child or teen has not yet contracted COVID-19, they are at risk, especially with the low number of vaccinated residents in North Dakota.