(photo by Eric Austin)

This is the first of a three-part series written by Eric W. Austin.

(The following does not necessarily constitute the opinions of The Town Line staff or its board of directors.)

Sometimes the noise from Washington is so loud, it drowns out what’s going on right here in Maine. A few months ago, the Maine Legislature wrapped up their first regular session with a final vote on a two-year state budget. So, with legislators on recess until January, I thought it would be a good time to catch up with them to discuss their thoughts on the recent legislative session.

In my research for this series of articles, I sat down with five Maine state legislators, including Senator Matt Pouliot, representing District 15 (Augusta, China, Oakland, Sidney and Vassalboro); and representatives Catherine Nadeau (Winslow and part of Benton), Bruce White (Waterville), Justin Fecteau (Augusta), and Richard Bradstreet (Vassalboro, Windsor, Somerville and part of Augusta). I thank each of these public servants for spending the time to answer my questions, and for their consent to have the interview recorded so I could provide accurate quotations.

This first article will look at some of the accomplishments of the last legislative session, with subsequent articles focusing on other issues that came up in our discussions, such as: the biggest challenges facing Maine over the next few decades, the impact of social media on local politics, and the state of partisanship in Augusta (it’s not as bad as you think!).

Maine’s first regular legislative session generally runs from January to June (in 2019, it ran a bit late as budget talks dragged into July). This first session is where the majority of bills are proposed and voted on and the all-important two-year budget is drawn up, debated and signed. Any bills not voted on during this first year may either go away or – if they have been specially authorized – they may be carried over into the second year, called the second regular session.

The second regular session will begin in January 2020, but only runs until about April. Although the legislature won’t have a full budget to contend with, it may still have supplemental budgetary items on which to vote, and the governor also has authority to submit additional bills for them to consider.

Justin Fecteau

By anyone’s estimation, 2019 was a busy legislative session. It was the kind of session that left an impression on freshman representative Justin Fecteau of Augusta, who sits on the Education and Cultural Affairs Committee. “I think we nearly broke the State House capacity,” he told me at Huiskamer Coffee House on Water Street, in Augusta, a business he runs with his wife, Grace, when he’s not teaching German at Maranacook Community High School.

“Twenty-one hundred bills were submitted for a six-month legislative session,” he said. “We were putting a lot on the people that work in the advisors office.” The legislative advisors office is a nonpartisan service in state government which helps legislators turn their ideas into legal text.

Catherine Nadeau

I asked Catherine Nadeau, a representative from Winslow who is serving her fourth and final term before retiring from the House in 2020, what legislative accomplishments she was most proud of from the last year. “We provided $130 million [in] property tax relief,” she responded. “That’s what we accomplished this year. We increased the Homestead Exemption by $5,000, [from $20,000] to $25,000. We expanded eligibility for the Property Tax Fairness Credit.” She also mentioned the inclusion of an additional 800 seniors under Maine’s Drugs for the Elderly program and the recent MaineCare expansion. She finished by saying, “This is what we got done, and we still have a surplus.”

Matt Pouliot

Senator Matt Pouliot, who also supported increasing the Homestead Exemption, recognizes the property tax burden on Mainers, especially for low income or fixed income residents. He actually wanted to raise the Homestead Exemption even higher. “I had a bill in to increase it to $50,000 with full reimbursement from the state,” he said, “because we are all hearing from our constituents: property taxes are a challenge for us – especially folks who are those baby boomers just getting into retirement, living on a fixed income. Even if their home is paid for, that property tax bill keeps going up and up and up, and it makes it more difficult for them to live on a fixed income.”

Bruce White

Bruce White, a freshman representative from Waterville, was particularly proud of the legislature for increasing the percentage of municipal revenue sharing this year. Municipal revenue sharing is a way of reimbursing cities which pay a larger percentage of state taxes.

“Cities like Waterville, where a lot of commuters come in during the day – you have the hospitals and colleges and stuff – [so] we have more strain on our city,” Representative White explained. “We need more fire safety, and police safety, and [the increase in municipal revenue sharing] helps us.

“It got decreased over the years,” he said. “It was down as low as two percent – it was supposed to be five [percent]. Waterville, for instance, in the last ten years, has lost – because it got reduced – about $1.1 to $1.2 million a year on average that we used to generate.”

The level of revenue sharing is always a tug of war between the state and city governments.

White continued, “We increased it from two percent to three percent starting in fiscal year 2020. For Waterville, that was $670,000 they received more than last year. That’s a big deal. That’s almost a mil right in Waterville. That helps our elderly, low income, middle class – everybody. That was a big success. The following year it goes up to 3.75 percent, so we’re on our way up to get it back to where it was originally.”

Despite the additional services delivered to Mainers like the expansion of MaineCare to benefit the state’s seniors and the increase in municipal revenue sharing, which will return more money back to local communities, both representatives White and Nadeau pointed to a surplus at the end of the last fiscal year and a growing Budget Stabilization (or “rainy day”) Fund.

The state’s accounting can be a bit tricky to untangle, especially since this particular subject is partial to a great deal of political spin, but essentially, the last fiscal year, ending June 30, saw a surplus of approximately $168 million, meaning this was the amount by which state revenues exceeded state expenditures. For some comparison, the state’s surplus from the previous two-year budget, in 2017, was $110.9 million. Since Maine is a state that requires a balanced budget by law, some surplus at the end of the year is expected.

The budget surplus is only part of the story, however. Also important is what the government decides to do with that surplus. This year, legislators rolled $139.2 of the $167.8 million back into the new budget, leaving $28.1 million of actual surplus. After a small amount (about $6 million) was set aside for several high priority requirements, including operating capital, the governor’s contingency account, the FAME loan insurance reserve, and state retiree health insurance, the remaining surplus, about $22.1 million, was divided according to an 80/20 split, with the largest portion, $18.1 million, deposited into the Budget Stabilization Fund, also known as the “Rainy Day Fund.” This is the state savings account meant to protect Maine from budget shortfalls in case of an unexpected recession or other statewide emergency. According to Maine’s Department of Administration and Financial Services, the total balance of our Budget Stabilization Fund, including this year’s deposit, is now at $236,904,105.

The other 20 percent of the remaining surplus, or about $4.5 million, was deposited into the Property Tax Relief Fund. This is a new fund created during the most recent legislative session, and replaces an account originally set up by the LePage administration simply called the Tax Relief Fund. In previous years, 20 percent of the state’s surplus was deposited into this fund with the intention that, when the fund reached a certain balance, it would trigger a permanent 0.2 percent reduction in the state income tax for all Maine residents. (The fund has never reached those specified limits, and so no reduction in the income tax rate has ever actually been triggered.)

However, this year the legislature made two changes to that earlier policy. First, the former Tax Relief Fund was combined with several other funds and renamed the Property Tax Relief Fund. It’s still fed through deposits of 20 percent of the state’s budgetary surplus, however the methodology which triggers tax relief for Mainers has been significantly changed. Instead of activating a permanent reduction in Maine’s income tax after reaching a specified balance, it will now trigger a rebate of at least $100 for Maine homeowners who have applied and qualified for the Homestead Exemption, once the fund has a sufficient balance to cover such a rebate. That limit was reached this year, so many of you should be receiving $100 checks in the mail by next March.

The change in how the tax relief is triggered is important because the old rules rewarded tax relief based on the level of a resident’s income, with higher income residents receiving a larger benefit than those on the lower end of the income scale. In contrast, under the new rules, all eligible homeowners collect the same $100 rebate regardless of income, although Mainers who are renters – or those who do not qualify for the Homestead Exemption – are left out in the cold.

While Maine’s Budget Stabilization Fund continues to grow, it’s current balance might not paint as rosy a picture as one might think. The two-year budget passed this year in the legislature totaled $7.98 billion, so although $237 million in Maine’s “Rainy Day Fund” might seem like a lot, is it really? Some representatives in Augusta don’t think so.

Richard Bradstreet

“Sooner or later we’re going to have a recession,” explained Vassalboro Representative Richard Bradstreet, who voted against the two-year budget. “It’s going to come and we have to be ready for that.”

Senator Matt Pouliot expressed similar reservations about the recent budget. “This is the first budget that I voted against in my seven years of legislative service,” he said, “because the increase in spending was just so drastic in such a short period of time that I couldn’t get behind it.”

The current budget represents an increase of just over 12 percent above the previous budget of $7.1 billion, signed in 2017. This increase is nearly three times more than the rate of inflation over the same period, although state revenues have also risen during that time. Most of the budget increases come from the expansion of Maine’s Medicaid program, MaineCare; the rise in the percentage of municipal revenue sharing; and increases for education and opioid treatment.

For some expert advice on Maine’s fiscal health, let’s turn to Sarah Austin, a policy analyst for the nonpartisan group, the Maine Center for Economic Policy (and of no relation to the author of this article). She testified earlier this year before the Maine House and Senate as a subject matter expert about the recent tax relief changes and the importance of building up cash reserves to help the state weather future economic storms.

Sarah Austin

“According to the most recent analysis from the Consensus Economic Forecasting Commission and Revenue Forecasting Committee,” she stated in her testimony from May, “Maine’s Budget Stabilization Fund contains only 37 percent of the funds necessary to withstand a moderate recession without cutting into baseline spending or raising revenue.”

I asked her via email if she was suggesting Maine still needed to do more to prepare for a possible economic downturn. She replied, “Good fiscal policy isn’t necessarily the rallying cry of the public, but yes, having reserves does impact the speed and adequacy of state responses during recessions. [A Budget Stabilization Fund of] $650 million could get us through a moderate recession without cutting services when they are most critical to supporting the economy.”

So, although the current financial reserves contained in Maine’s Budget Stabilization Fund are at some of their highest levels ever, good fiscal policy suggests they should be significantly higher if Maine is to survive a sudden slump in the economy unscathed.

And that is just one of the challenges Maine is facing as we head toward the middle of the 21st century. Based on my discussions with five local legislators, the next article in this series will take a deeper look at the biggest obstacles to Maine’s continued growth and prosperity: things like an aging workforce and the difficulty of attracting younger families to settle and build their lives here in Maine, the state’s need for skilled tradesmen and how it’s driving up prices for everyone, rising healthcare costs and the increasing strain on Maine’s do-it-all school systems, and much, much more!

Eric W. Austin writes exclusively for The Town Line newspaper about issues important to central Maine. He can be reached at ericwaustin@gmail.com.

Two local graduates were selected to receive the 2019 Alva S. Appleby Scholarship from the Maine Dental Association Charitable Foundation.

Two local graduates were selected to receive the 2019 Alva S. Appleby Scholarship from the Maine Dental Association Charitable Foundation.

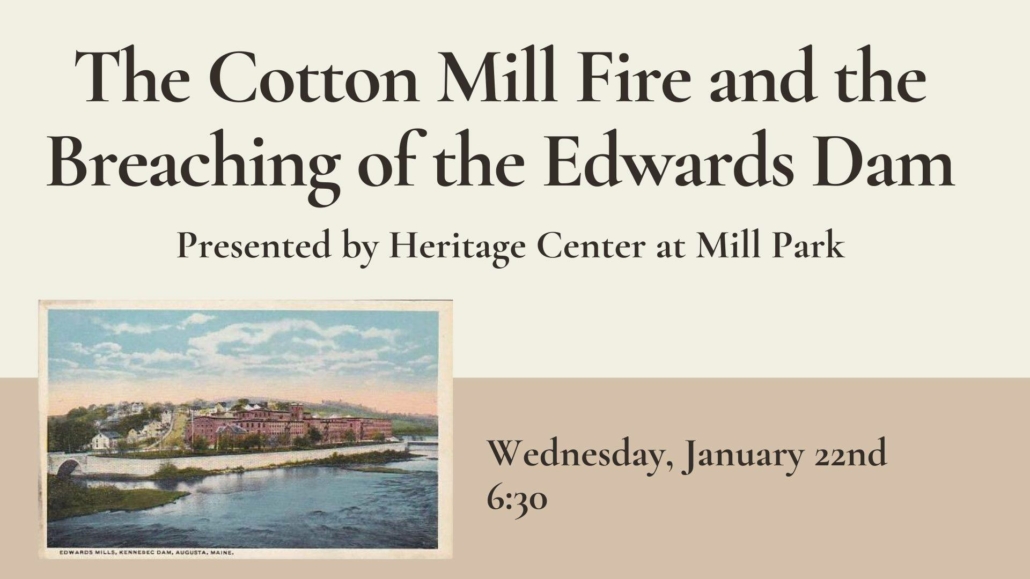

The Kennebec Historical Society has received a $5,000 grant from the Morton-Kelly Charitable Trust to catalog the society’s growing collection, buy archival supplies and replace an aging computer. The society will use the grant to pay two interns who will address the backlog of donated materials and to purchase the protective archival boxes and folders necessary to properly preserve documents, photographs, scrapbooks, maps, manuscripts, books, and ephemera.

The Kennebec Historical Society has received a $5,000 grant from the Morton-Kelly Charitable Trust to catalog the society’s growing collection, buy archival supplies and replace an aging computer. The society will use the grant to pay two interns who will address the backlog of donated materials and to purchase the protective archival boxes and folders necessary to properly preserve documents, photographs, scrapbooks, maps, manuscripts, books, and ephemera.

When Jim Whyte settled outside the slate mining town of Monson, Maine, in 1895, people hardly knew what to make of him. And almost 130 years later, we still don’t. A world traveler that spoke six languages fluently, Whyte came to town with sacks full of money and a fierce desire to keep to himself. It was clear that Whyte was hiding from something – enough to make even the FBI to eventually come looking. But even the Feds couldn’t imagine how Whyte, who lost every penny he had when World War I broke out, amassed another fortune before he died. Based on the true story, Hermit follows one man’s quest to discover all he can about Whyte’s secret life before it’s too late.

When Jim Whyte settled outside the slate mining town of Monson, Maine, in 1895, people hardly knew what to make of him. And almost 130 years later, we still don’t. A world traveler that spoke six languages fluently, Whyte came to town with sacks full of money and a fierce desire to keep to himself. It was clear that Whyte was hiding from something – enough to make even the FBI to eventually come looking. But even the Feds couldn’t imagine how Whyte, who lost every penny he had when World War I broke out, amassed another fortune before he died. Based on the true story, Hermit follows one man’s quest to discover all he can about Whyte’s secret life before it’s too late.