Europeans trading furs with the natives.

For those who don’t recognize my name, I wrote stories about China and Vassalboro local meetings until they were canceled. Now I plan a series on the history of this part of the Kennebec Valley, starting with today’s introduction to two of eight towns — some now cities — created along the Kennebec River between Augusta and Fairfield. As our present circumstances range from the inconvenient to the fatal, it seems appropriate to look selectively at the highs and the lows (followers of The Capitol Steps will instantly flip the initial letters of the two nouns) of our area before our time here.

What is now, and has been for 200 years, the State of Maine, was first explored and settled by Europeans by way of the Atlantic Ocean (see The Town Line, March 19, 2020), and ocean transportation has been important in its history and economy ever since (see The Town Line, March 12, 2020).

From the coast, European exploration, land claims and settlements moved inland up rivers, for the obvious reason that boats and ships were the major means of moving people and especially goods. Although the area was well inhabited before Europeans arrived, Native tribes did not use wheeled vehicles; their trails were unsuited to wagons and even to horseback riders.

From the coast, European exploration, land claims and settlements moved inland up rivers, for the obvious reason that boats and ships were the major means of moving people and especially goods. Although the area was well inhabited before Europeans arrived, Native tribes did not use wheeled vehicles; their trails were unsuited to wagons and even to horseback riders.

Rivers maintained their importance as running water became a source of industrial power, encouraging the growth of towns and cities. As more people arrived, European population expanded outward from river basins.

The central part of the Kennebec River, from Augusta through Waterville on the west bank and Clinton on the east bank, illustrates these generalizations.

The area was part of the land granted to the Plymouth Colony of Massachusetts by King James I of England. The grant extended for 15 English miles on each side of the river.

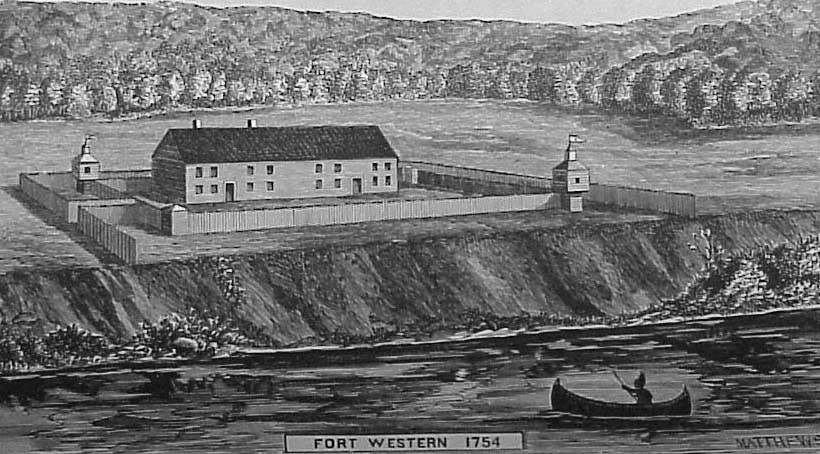

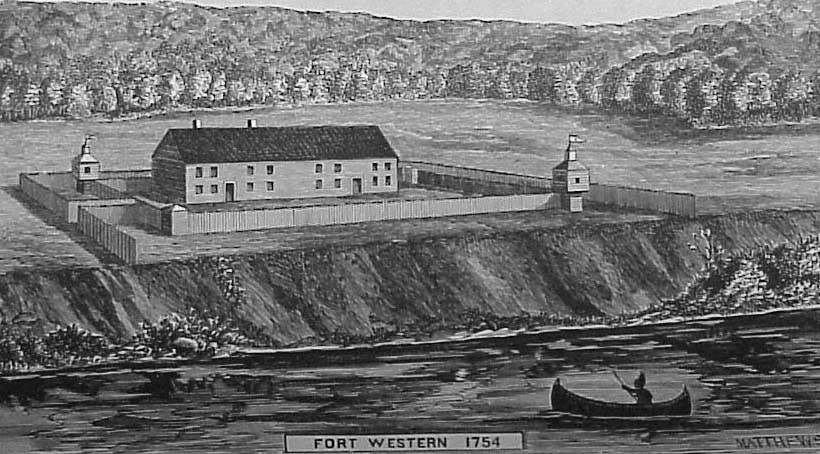

Leaders of the Plymouth Colony built a trading post on the east shore at Cushnoc, where Fort Western, in Augusta, now stands, in 1625, and traded with local Natives for almost 40 years. According to Henry D. Kingsbury, principal editor of the immense and detailed History of Kennebec County Maine 1625-1892, visitors to the site included Governor William Bradford, Captain Miles Standish and John Alden (of “Why don’t you speak for yourself, John?” fame).

When the Native inhabitants, backed by French from Canada, again tried to drive out English settlers beginning in the 1660s, the Cushnoc post closed and the English retreated to the coast. Nonetheless, Kingsbury calls the Plymouth colonists, “remotely the pioneers of Augusta.”

By the 1750s, the French & Indian threat had diminished so that settlement of inland Maine became possible.

Thus in 1753, the General Court in Boston endorsed a new company called the Kennebec Purchase, opening the way to legal settlement of the Kennebec River valley. Bostonians Dr. Sylvester Gardiner and Florentius Vassall were two of the leading investors. The Plymouth Colony built Fort Western, in Augusta, the same year, and in 1754 built Fort Halifax, in Winslow, and a road connecting them.

The present City of Augusta and state capital had its origin on the east bank of the river at the Cushnoc site. In 1761, surveyor Nathan Winslow laid out and marked lots on land extending three miles from the Kennebec on both sides, covering present-day Augusta and parts of neighboring towns. Kingsbury comments that many of those lot lines exist today, as roads, lot lines and other divisions.

The plan in Kingsbury’s Kennebec County history closely resembles the riverine piece of the Vassalboro plan described below: mile-deep narrow lots along the river, mile-deep three-times-as-wide lots in the next tier; mile-deep lots half as wide as the second ones for the third tier. A major difference is that almost every lot has one or more names written on it.

In 1771, the Fort Western settlement was incorporated as the town of Hallowell – not the Hallowell we know, but a 65,715-acre-tract that included present-day Hallowell, Augusta, Chelsea and much of Farmingdale and Manchester.

Residents of the north end of the new town, known as The Fort, and the south end, called The Hook, disagreed about many things, including religion. The breaking point came in February 1796, when the Massachusetts General Court approved building the first bridge across the Kennebec from The Fort, though Hook residents also wanted it. People from the two areas demanded separation, and on Feb. 20, 1797, the north end was incorporated as the Town of Harrington.

Fort Western in 1754.

The name honored one of George II’s ministers, Lord Harrington. It had been used in 1729 on the Maine coast for what is now Bristol, and did not last long.

The new Harrington’s residents did not like the name either. The Massachusetts General Court granted their petition to change it to Augusta on June 9, 1797.

Kingsbury guesses opposition to the first name might have been because migratory fish were caught there and remaining Hallowell residents corrupted the new name to Herring-town.

The name Augusta, like Harrington, had been used before, for a small settlement in what is now Phippsburg that was destroyed by an Indian raid. Kingsbury surmises the name might have been chosen for the new inland town simply because it was not easily made into a joke.

Other sources say the name honors Augusta Dearborn, daughter of New Hampshire physician Henry Dearborn, who fought in the Battle of Bunker Hill, accompanied Benedict Arnold on the famous march to Québec that went up the Kennebec and later served as Secretary of War under President Thomas Jefferson, and in the U. S. House of Representatives.

The Town of Vassalboro is the next town north of Augusta on the east side of the river. It is named after Florentius Vassall and was at first spelled Vassalborough; the town clerk had adopted the modern spelling by 1818, according to Alma Pierce Robbins’ 1971 History of Vassalborough Maine. Originally the town was 31 miles wide, 15 miles on each side of the Kennebec plus a mile’s worth of river.

A plan of the eastern half reproduced in the 1971 history is apparently the work of two successive surveyors. In 1761, the Kennebec Purchase Proprietors had Nathan Winslow survey the first three miles inland from the river. In 1774 they hired John Jones to survey another two miles from the river and to lay out lots.

The plan, reportedly a 19th-century copy of the original Jones map, shows 47 lots extending east from the river. According to the Vassalboro history, they were supposed to be 50 rods wide by one mile deep. Next came a narrow line that might be a rangeway and another tier of lots, each three times as wide as the riverfront ones, that were reserved for the proprietors. After another maybe-rangeway, a third tier, each lot half as wide as those in the second tier, encompassed “7 Mile Pond” (now Webber Pond).

A comparatively wide north-south open area, probably the demarcation between the two surveys, is bounded on the east by two more tiers of the medium-sized lots separated by a possible rangeway.

“12 Mile Pond,” now China Lake, is identified creating an irregularity in the northeastern side of the plan, and a rounded intrusion in the southeast suggests that what is now Three Mile Pond was known but not mapped.

In the 21st century, surveyors define a lot that is more than twice as long as it is wide as a “spaghetti lot.” In Maine law, the definition is “a parcel of land with a lot depth to shore frontage ratio greater than 5 to 1.” In 1993, spaghetti lots were forbidden in land under the jurisdiction of the Land Use Planning Commission.

MAJOR SOURCES:

Kingsbury, Henry D., ed. Illustrated History of Kennebec County Maine 1625-1892 1892\Robbins, Alma Pierce History of Vassalborough Maine 1771 1971 n.d. (1971)

Web sites, miscellaneous

NEXT: Staying on the east side of the Kennebec, earliest history of Winslow, Benton and Clinton.

by Tim Forsman

by Tim Forsman Oak Grove School Foundation will not be sending grant awards this Spring due to the Covid-19 virus and the stressed condition of our financial resources. We are thankful for all the people in our community who exert themselves for the well being of the young people that Oak Grove seeks to support. We look forward to recovering from this pandemic and returning to the major grant business in 2021.

Oak Grove School Foundation will not be sending grant awards this Spring due to the Covid-19 virus and the stressed condition of our financial resources. We are thankful for all the people in our community who exert themselves for the well being of the young people that Oak Grove seeks to support. We look forward to recovering from this pandemic and returning to the major grant business in 2021.

From the coast, European exploration, land claims and settlements moved inland up rivers, for the obvious reason that boats and ships were the major means of moving people and especially goods. Although the area was well inhabited before Europeans arrived, Native tribes did not use wheeled vehicles; their trails were unsuited to wagons and even to horseback riders.

From the coast, European exploration, land claims and settlements moved inland up rivers, for the obvious reason that boats and ships were the major means of moving people and especially goods. Although the area was well inhabited before Europeans arrived, Native tribes did not use wheeled vehicles; their trails were unsuited to wagons and even to horseback riders.

On Friday, March 27, the Maine Bureau of Veterans’ Services (MBVS), in collaboration with the VA Maine Healthcare System, will host a recognition ceremony for Vietnam Veterans. The ceremony will take place at the Augusta Armory from 1 to 4 p.m.

On Friday, March 27, the Maine Bureau of Veterans’ Services (MBVS), in collaboration with the VA Maine Healthcare System, will host a recognition ceremony for Vietnam Veterans. The ceremony will take place at the Augusta Armory from 1 to 4 p.m.